When managed properly, a credit card can be an invaluable financial tool. However, if used recklessly, it can lead to significant debt. To ensure your financial health remains intact, it’s crucial to implement strategies to steer clear of burdensome liabilities. By maintaining financial discipline and being aware of spending habits, you can avoid common pitfalls associated with revolving credit.

Understanding the ins and outs of personal finance is essential when it comes to avoiding high balances. From setting a budget to regularly reviewing your financial statements, there are several steps you can take to ensure that you use your credit facilities responsibly. Making informed decisions about borrowing and spending can go a long way in preventing any financial hardships that may arise from credit issues.

Managing your credit spending

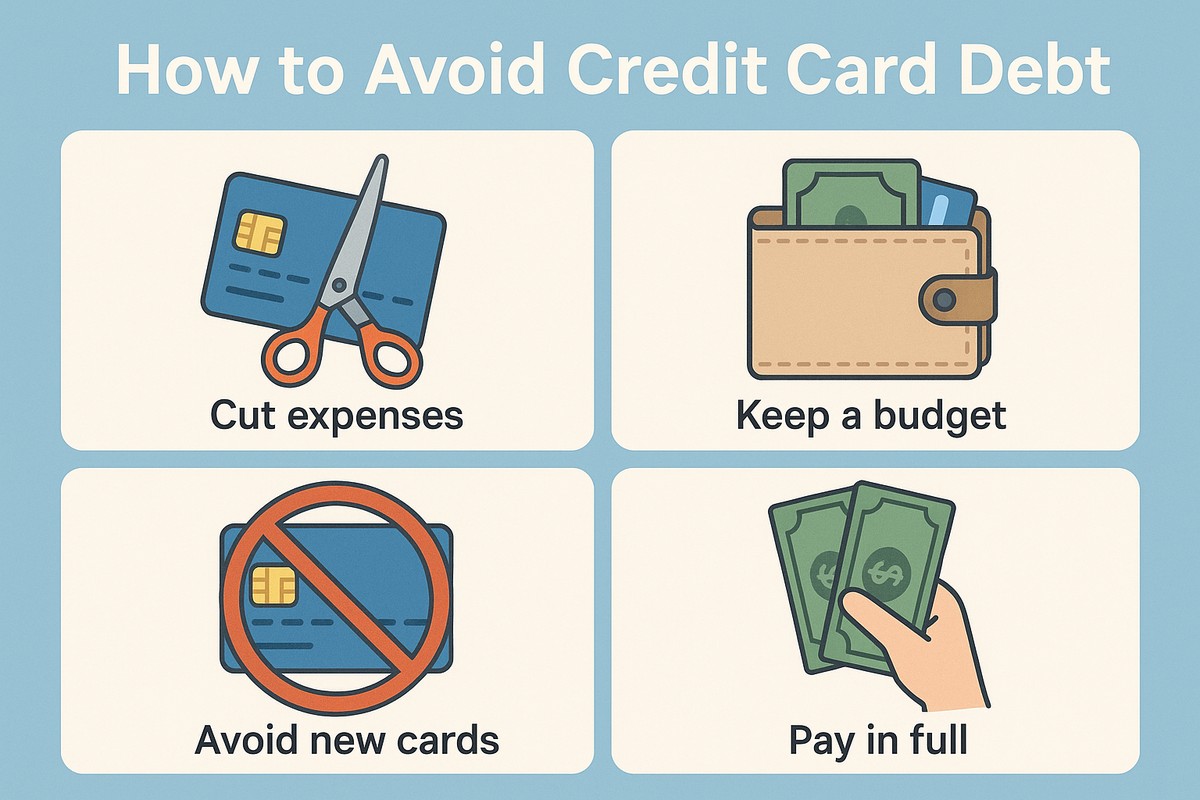

Setting realistic limits on your usage is a primary method of avoiding debt. Understanding your financial situation and only spending what you can afford to pay back each month is crucial. This means not maxing out your card and keeping your balance below a certain percentage of your credit limit. Additionally, being mindful of impulse purchases and unnecessary spending can safeguard you from financial strain.

Regularly checking your account balance and keeping track of expenses helps you stay on top of your payments. Making only the minimum required payment can result in accumulating interest, which exacerbates the financial burden over time. Aiming to pay more than the minimum due whenever possible can help reduce your overall debt faster.

Setting a practical budget to control expenses

Creating a budget tailored to your individual financial circumstances is an effective way to manage your finances. It allows you to allocate funds for necessary expenses while identifying areas where you can cut back. By categorizing your spending into essentials like groceries and utilities, and discretionary spending such as dining out or entertainment, you can better control your financial outflow.

To ensure that your budget is successful, monitor your spending carefully and adjust your budget as necessary when changes to your income or expenses occur. This proactive approach allows you to make informed decisions and avoid falling into debt. Keeping an eye on spending habits also helps identify patterns that need adjusting for the future.

Smart tips for preventing credit pitfalls

One of the best ways to stay debt-free is by using alternative payment methods whenever possible. Opting for debit cards or cash ensures that you’re spending only what you have. Additionally, setting up automatic payments for your accounts can prevent missed payments, which may lead to late fees and higher interest rates.

Review your monthly credit statements for any inaccuracies or unauthorized charges. Understanding these transactions allows you to catch errors early and manage your account effectively. Remaining vigilant with these statements gives you a clear picture of how you’re utilizing your resources.

Strengthening financial habits for long-term stability

Developing consistent financial habits is key to maintaining control over your credit use. This includes reviewing your goals regularly, setting aside money for unexpected expenses, and understanding how each financial decision affects your overall stability.

By building a strong foundation of responsible habits, you create a buffer against potential missteps and reinforce a mindset that prioritizes long-term financial well-being. This empowers you to stay disciplined even when unexpected financial challenges arise.

Conclusion on managing financial health

In conclusion, avoiding credit card debt is largely about maintaining awareness and exercising control over one’s financial activities. By making strategic choices and sticking to a well-devised spending plan, you can keep your liabilities in check.

Regularly reviewing financial priorities and adjusting your strategies as needed will ensure that you remain on the right track. With prudent management of personal finances, you’ll be able to enjoy the benefits of having access to credit without encountering the stress of overwhelming debt.