Improving your credit score is an essential part of managing your finances. In the U.S., a healthy credit score can open doors to better loan terms, lower interest rates, and even affect rental agreements or job prospects. By understanding how your credit works and taking proactive steps, you can significantly boost your financial standing.

One of the primary factors determining your credit score is your payment history. Ensuring timely payments on all credit accounts is crucial. Late payments can have a severe impact on your score, often staying on your credit report for several years. Setting up automatic payments or reminders can help you consistently pay on time.

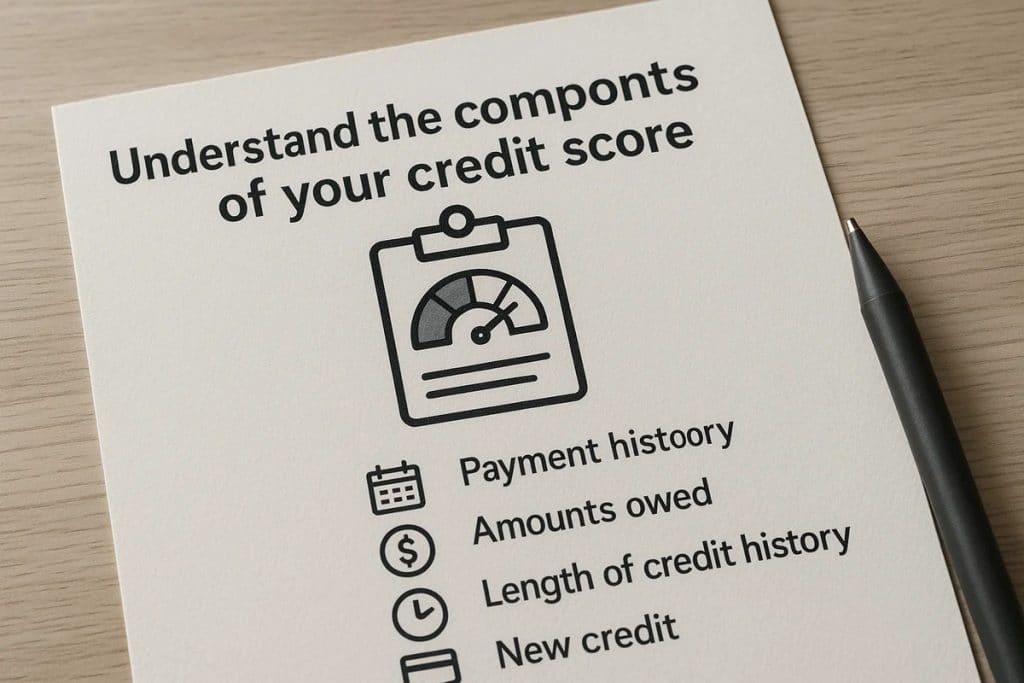

Understand the components of your credit score

Being aware of the different elements that make up your credit score can offer you a clear pathway to improvement. Typically, your score is based on payment history, amounts owed, length of credit history, new credit, and types of credit used. By focusing on each aspect, you can take specific actions to work towards a better score.

For example, maintaining older credit accounts can positively influence the length of your credit history, which constitutes a significant portion of your score. Another essential component is managing your credit utilization ratio. By keeping your balances low relative to your credit limits, you signal to lenders that you are responsible with credit.

Regularly review your credit reports

Accessing your credit reports regularly allows you to monitor your financial status and spot any errors that might affect your credit score. You are entitled to a free credit report annually from each of the three main credit bureaus: Equifax, Experian, and TransUnion. By examining these reports, you can catch inaccuracies or possible fraudulent activities and address them promptly.

Using tools like credit monitoring services can also offer alerts on any changes to your credit report, keeping you informed about your financial health. Being proactive in reviewing your credit information helps prevent surprises and ensures you’re on track to reaching your credit goals.

Build and manage credit responsibly

Responsible use of credit is crucial for maintaining a strong credit score. This means not only paying your bills on time but also making decisions that affect your long-term financial standing. Consider diversifying your credit types, as having various forms of credit, such as credit cards, installment loans, or a mortgage, can positively impact your score.

Handle new credit applications carefully; applying for multiple accounts in a short period can negatively affect your credit score. Instead, space out applications and focus on building a reliable history with existing accounts. Responsible credit management paves the way for a more robust financial future.

Adopt strategic credit habits

Strategic credit habits can make a big difference in improving your score. For example, paying your credit card bill more than once a month can keep your balance low and enhance your utilization ratio. Establishing a budget and sticking to it can prevent overspending and help you manage payments effectively.

Education is key; understanding credit terms and conditions enables informed decision-making. Work towards becoming financially literate, as this knowledge will empower you to maintain healthy credit habits throughout your life.

Conclusion: Take charge of your financial future

Improving your credit score is a journey that requires patience and persistence. By understanding the factors that impact your score and taking targeted actions, you can gradually achieve a better financial standing.

Staying informed about your credit status and adopting responsible habits are instrumental in this process. As you work towards a higher score, you’ll find yourself in a better position to secure favorable financial opportunities.